Starting a Business in the Philippines with an SRRV**

**Business Ownership and Structure**

* **Starting a Business:** The SRRV doesn't automatically grant permission to engage in business activities. While you can own shares in a corporation, directly operating a business may be restricted, depending on the nature of the business and Philippine laws governing foreign ownership in specific sectors.

* **Sole Proprietorship:** Generally, foreigners cannot register a sole proprietorship in the Philippines. This business structure is usually reserved for Filipino citizens.

* **Corporation and Partnerships:** You may participate in a corporation or partnership, but foreign ownership restrictions apply to certain industries. The exact limitations depend on the specific business sector and may require compliance with the Foreign Investments Act (FIA).

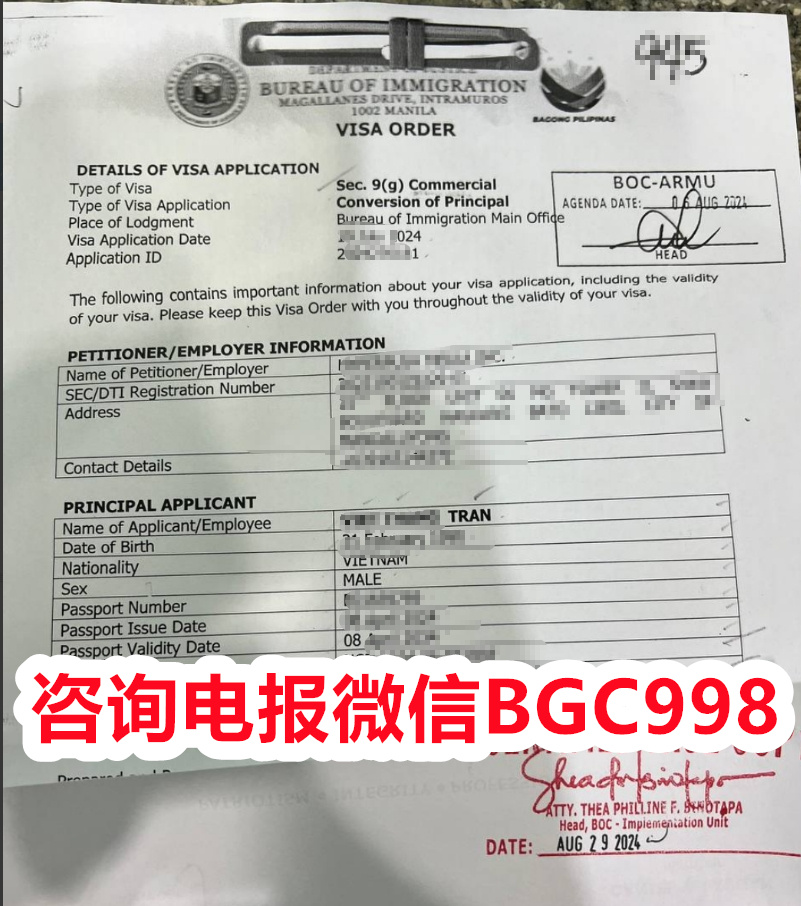

* **DTI and SEC Registration:** Depending on the chosen business structure (corporation or partnership), you would register with either the Department of Trade and Industry (DTI) or the Securities and Exchange Commission (SEC). The SRRV itself doesn't grant automatic approval for registration; you must still meet all other requirements.

**Employment and Work Restrictions**

* **Hiring Employees:** Hiring employees is generally not permitted under the SRRV. It's considered gainful employment, which is typically prohibited unless you obtain the necessary work permits and licenses.

* **Alien Employment Permit (AEP):** If you intend to hire Filipino employees, you'll likely need an AEP. This permit is crucial for complying with Philippine labor laws.

* **Online Work and Freelancing:** The SRRV's restrictions on gainful employment extend to online work and freelancing. However, the interpretation of "gainful employment" can be complex and may depend on the nature and scale of your online activities. If it's considered a business rather than a hobby, separate permits may be required.

* **Dependents' Work Restrictions:** Dependents of SRRV holders generally face the same restrictions on gainful employment. They cannot work without the proper permits.

* **Consulting Services:** Offering consulting services may fall into a gray area. If it's considered a business activity, it would likely require compliance with the same regulations as other business ventures. The scale and nature of the consulting work would be key factors in determining whether it violates the SRRV's restrictions.

**Important Considerations**

* **Legal Counsel:** It's strongly recommended to seek legal advice from a lawyer specializing in Philippine business and immigration law. The regulations are complex and subject to change.

* **Philippine Retirement Authority (PRA):** Consult the PRA for the most up-to-date information on SRRV regulations and any potential exceptions.

This information is for general guidance only. Always seek professional legal and financial advice before making any decisions related to starting a business in the Philippines while holding an SRRV.欢迎 咨询 联系我们 微 信:BGC998 电报@ BGC 998 或 微信:VBW333 电报@VBW777 因业务咨询量比较多,为了节约您的宝贵时间,咨询请主动告知咨询业务和问题,菲律宾9 9 8咨询 是菲律宾MAKATI 实体注册公司,在菲律宾已经有超过19年服务经验,客户 隐私安全保护服务可靠,业务提交可以安排工作人员上门取件或前往我们办公室提交 。菲律宾政策时常变化,且信息发布有时间差,有需要相关业务最新资讯欢迎 联系我们.